The mobile phone’s relative success can be attributed to the fact that it continually evolves to meet user demand, is flexible, multi-functional and relatively easy to use. Pagers on the other hand offer only limited one way communication. You can’t respond from a pager. In the IT world for support roles, pagers were very useful until the mobile came along. As soon as SMS and Apps on phones appeared the pager was redundant. The phone is also hand sized and portable . The phone is continually evolving as mentioned so doesn’t disappear from the marketplace and there is no foreseeable replacement. It is a large part of the population’s daily life. In hospital’s the reliability and ease of use for sufficient functionality is life critical. The costs of the phone’s components are also coming down, enabling better phones in for example the camera function.

Applying this to predict the Next 5 years in a Large Multifunctional Bank

A large multifunctional bank offering retail, corporate, investment and private banking faces significant pressure currently to digitalize all aspects of its services and functions to compete, provide offerings that a customer requires and meet ever complex regulatory requirements.

Currently

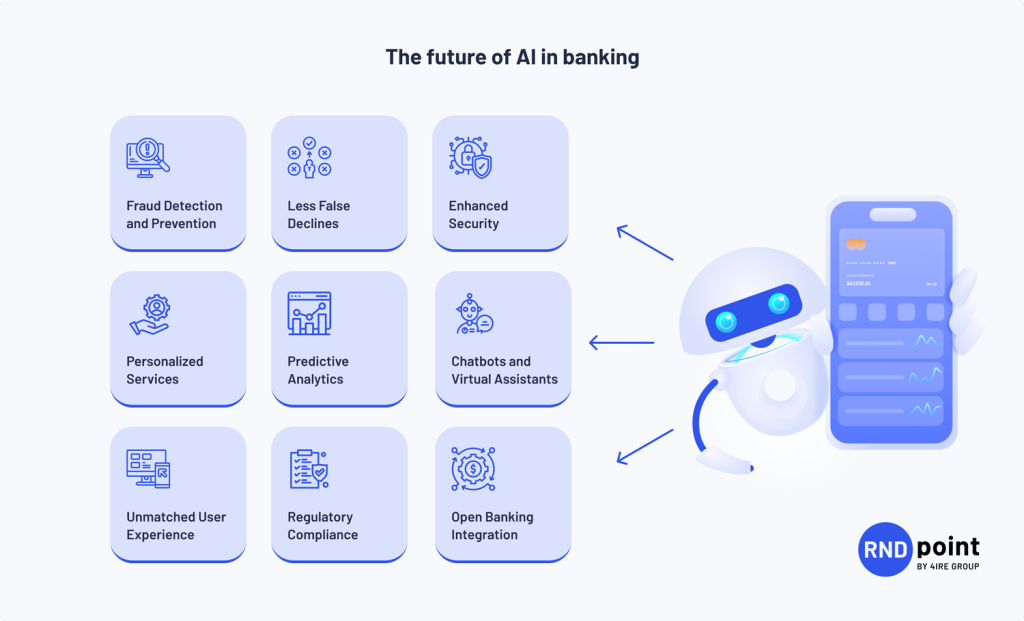

AI tools are being implemented at pace as enablers for the employees to create the software that can meet these requirements.

• Chatbots – for customers and employees to automatically answer questions 24×7

• AI tools to speed up and improve the quality of the written software for the employees

• AI financial advice systems to provide customers with real time financial advice to prevent loss of customers and gain data about customer profiles to improve these offerings

• AI driven fraud detection and regulatory compliance to maintain the ratings and compliance of the bank.

Mid-Term (2-5 Years)

With the rapid evolvement of AI the banks will have to:

• Offer more tailored and intelligent products that meet an ever sophisticated customer base

• Enable seamless onboarding to make sure customers first impressions of the bank are excellent

• Enable automatic and quick product selection based on customer characteristics, like loans and mortgages

• AI tools for monitoring of internal systems, processes and networks for increasingly intelligent attackers

• AI enablers for staff and customers to keep the bank attractive (Chatbots and employee tools)

The Obstacles

To make these transformations, the banks face significant obstacles:

• A large unskilled workforce that needs to be retrained

• An ever stricter regulatory regime that needs to be adhered to

• A customer base that is increasingly tech and AI savvy

• Wade of attackers and fraudsters

• These AI enablers need to be integrated into legacy systems which are largely complex and difficult to integrate

Conclusion

In order to succeed, the banks, just like the mobile phones need to evolve to meet the requirements of the market place with products that improve over time. They need to reduce costs to be competitive. Trust and regulatory compliance is also a key ingredient of a bank’s success. AI and Digitalization is the next step that they are all taking to achieve these goals.

Acknowledgements

Grok and ChatGPT were used to assist in the compilation of this document